|

Financial Profile: |

|

|

|

|

|

Yemen General Insurance

Co. |

|

|

Figs in Yr. ‘000 |

|

|

|

|

2020 |

2019 |

2018 |

|

|

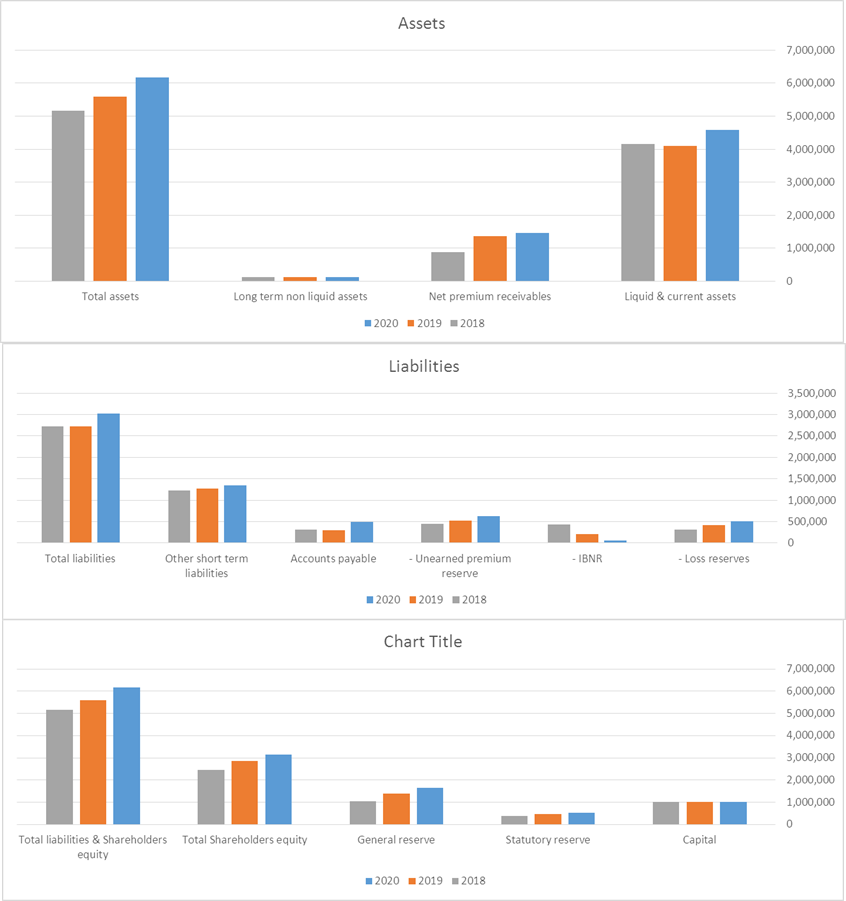

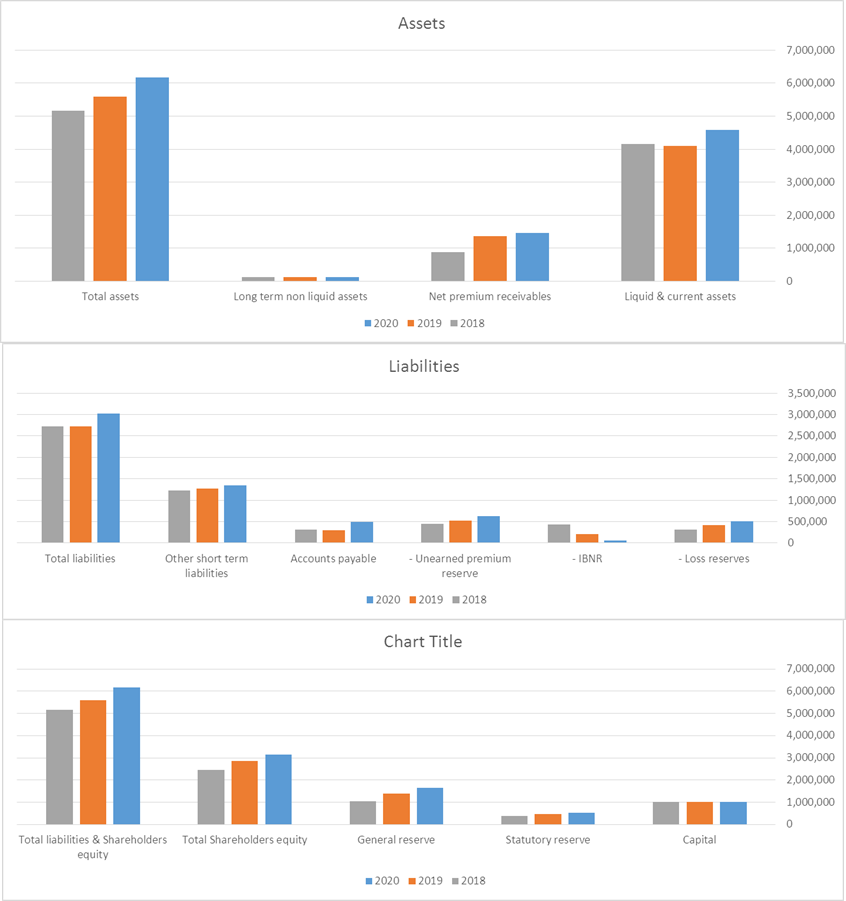

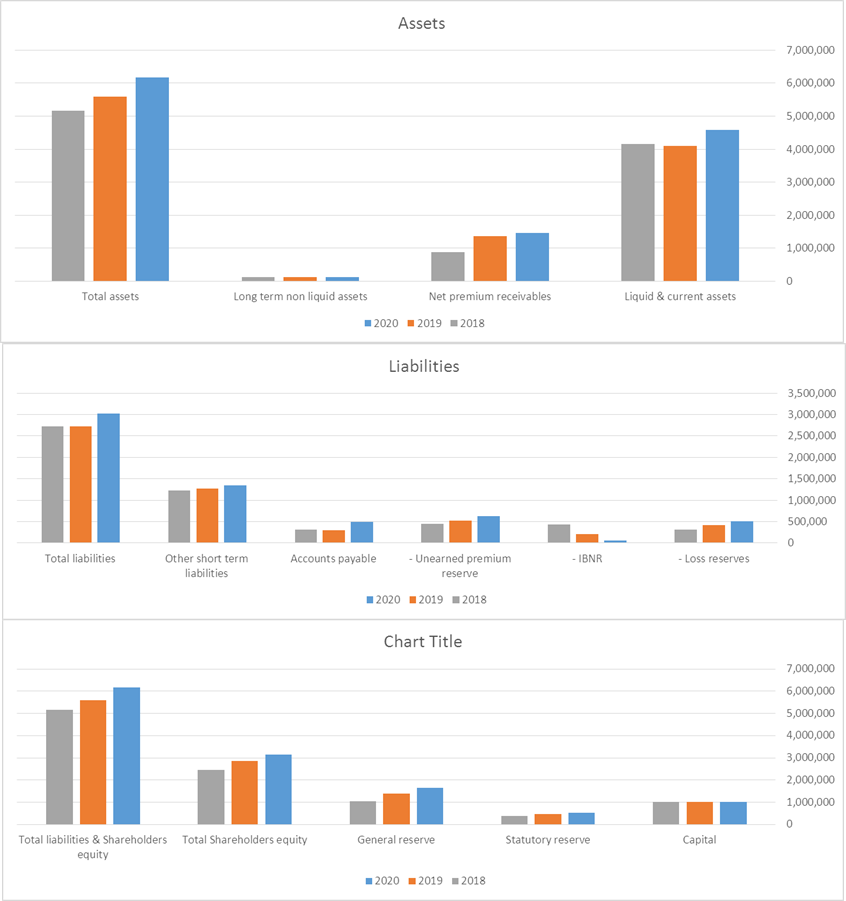

Assets: |

|

|

|

|

|

Liquid & current assets |

4,588,907 |

4,091,376 |

4,162,422 |

|

|

Net premium receivables |

1,462,954 |

1,371,968 |

884,385 |

|

|

Long term non liquid assets |

122,834 |

118,212 |

123,889 |

|

|

Total assets |

6,174,695 |

5,581,556 |

5,170,696 |

|

|

|

2020 |

2019 |

2018 |

|

|

Liabilities - Technical

reserves: |

|

|

|

|

|

- Loss reserves |

503,220 |

414,921 |

317,660 |

|

|

- IBNR |

60,000 |

214,000 |

427,500 |

|

|

- Unearned premium reserve |

631,208 |

527,840 |

452,787 |

|

|

Accounts payable |

496,804 |

295,084 |

306,504 |

|

|

Other short term liabilities |

1,349,849 |

1,273,274 |

1,220,416 |

|

|

Total liabilities |

3,021,081 |

2,725,119 |

2,724,867 |

|

|

|

2020 |

2019 |

2018 |

|

|

Shareholders equity |

|

|

|

|

|

Capital |

1,000,000 |

1,000,000 |

1,000,000 |

|

|

Statutory reserve |

515,265 |

460,548 |

394,487 |

|

|

General reserve |

1,638,349 |

1,395,889 |

1,051,342 |

|

|

Total Shareholders equity |

3,153,614 |

2,856,437 |

2,445,829 |

|

|

Total liabilities &

Shareholders equity |

6,174,695 |

5,581,556 |

5,170,696 |

|

|

#Authorized Paid up

capital increased to YR 1 Billion as at 6/04/2010

self financed from internal resources. |

|

|

|

|

|

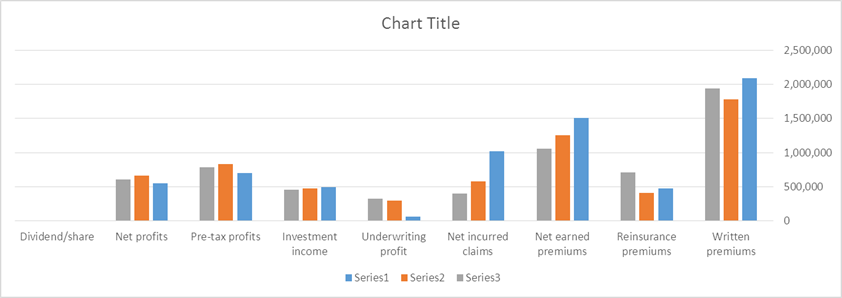

Other Key Figures: |

|

|

|

2020 |

2019 |

2018 |

|

|

Written premiums |

2,086,817 |

1,784,137 |

1,943,767 |

|

|

Reinsurance premiums |

478,238 |

408,520 |

712,368 |

|

|

Net earned premiums |

1,505,211 |

1,257,897 |

1,054,357 |

|

|

Net incurred claims |

1,023,798 |

578,549 |

402,419 |

|

|

Underwriting profit |

59,652 |

294,892 |

323,209 |

|

|

Investment income |

496,947 |

475,058 |

452,996 |

|

|

Pre-tax profits |

702,256 |

830,760 |

780,857 |

|

|

Net profits |

547,177 |

660,608 |

609,528 |

|

|

Dividend/share |

250 |

250 |

250 |

|

|

Source :

Audited final accounts & related information |

|

|

Rating :

2001 "BB-" , 2002 "BBB" (Muhanna & Co. Rating

services, Beirut) |

|

|

Bankers: Arab Bank. |

|

|

Auditors: A. Raouf Al Ezzie, Correspondents to Talal

Abu Ghazaleh |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|